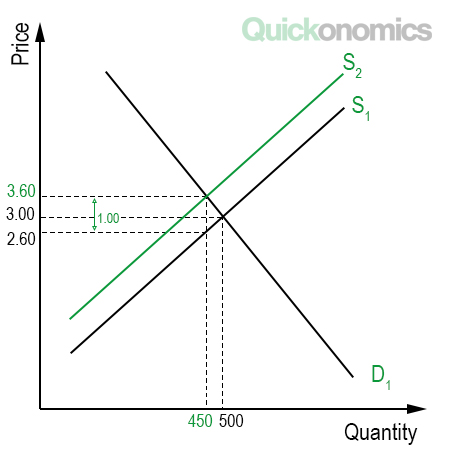

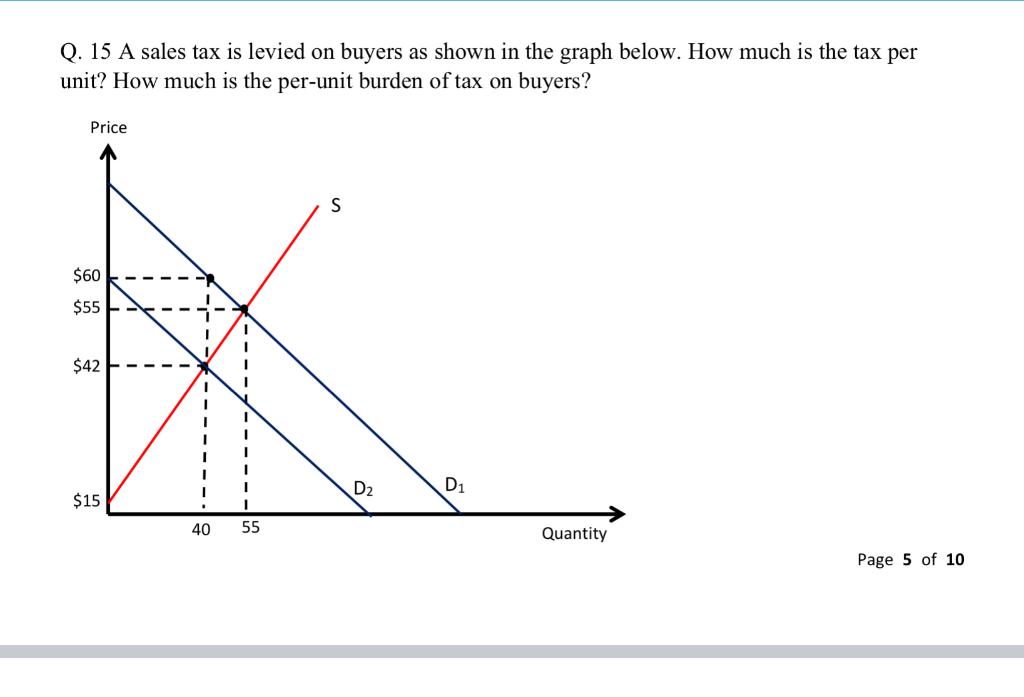

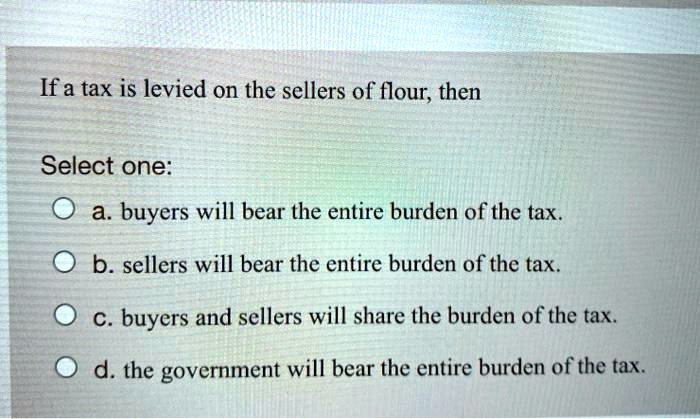

SOLVED: If a tax is levied on the sellers of flour,then Select one: a. buyers will bear the entire burden of the tax O b.sellers will bear the entire burden of the

The burden of railway rates: Freight and express charges levied upon the people of western Canada unjustifiably higher than those in eastern Canada ... in the Manitoba Free Press, Winnipeg, April,: Anonymous:

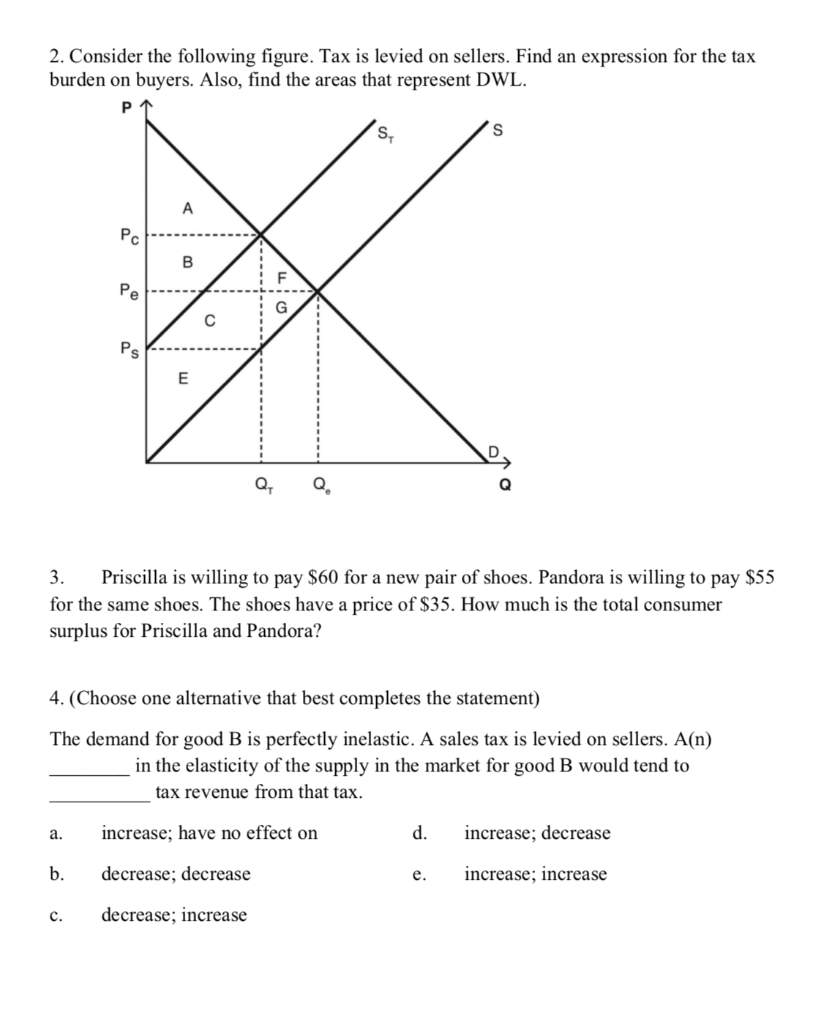

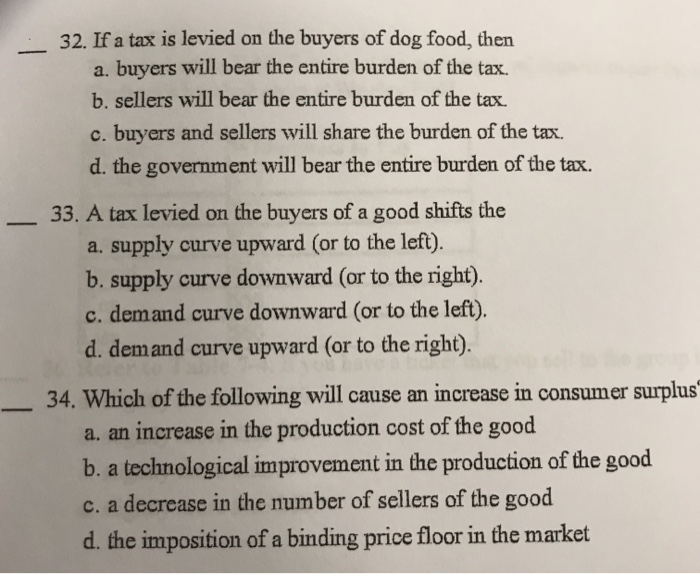

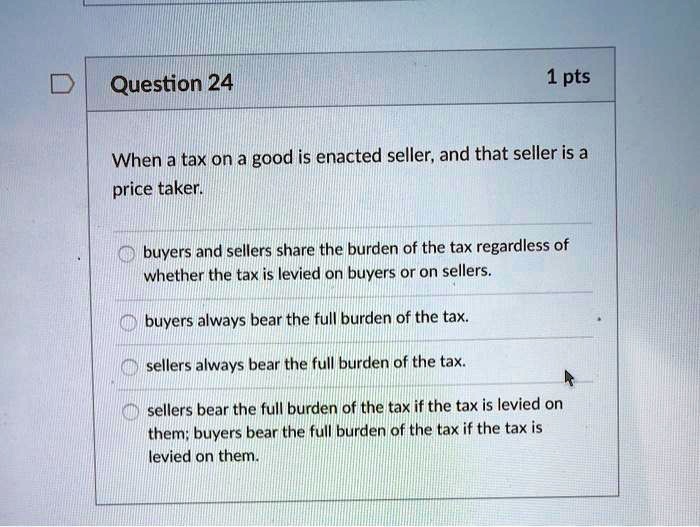

SOLVED: when a tax on a good is enacted seller, and that seller is a price taker Question 24 1pts When a tax on a good is enacted seller,and that seller is

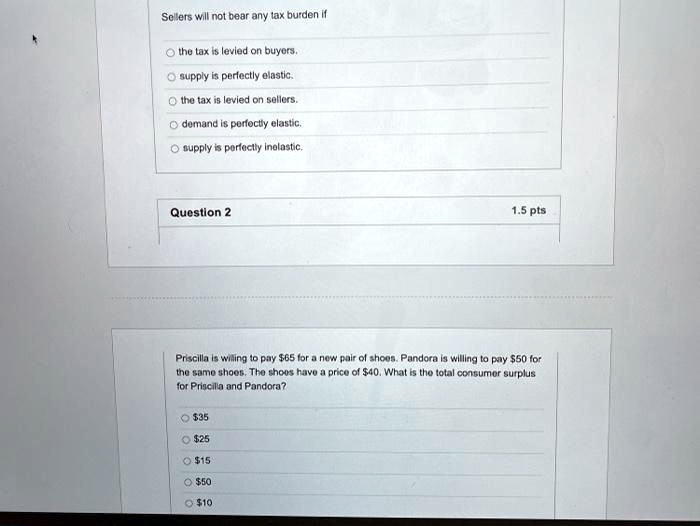

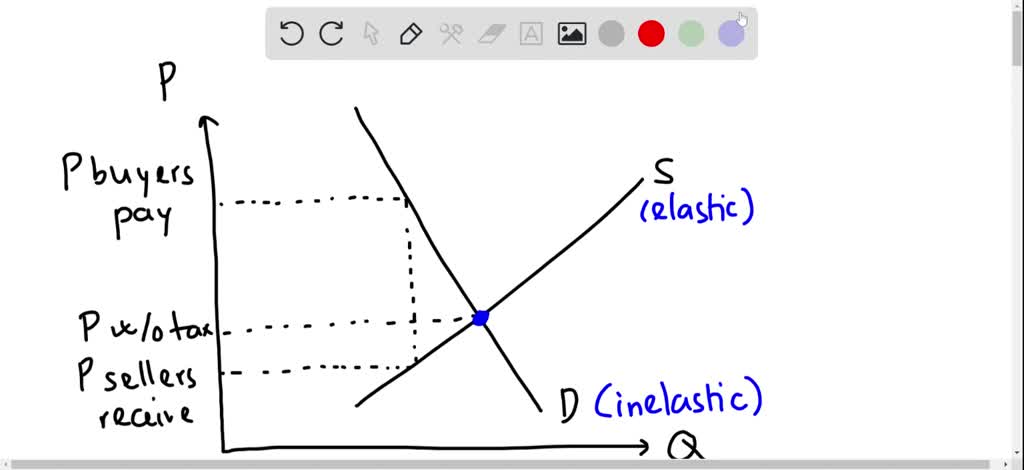

SOLVED: Sellers will not bear any tax burden if O the tax is levied on buyers Osupply is perfectly elastic O the tax is levied on sellers O demand is perfectly elastic

Tax bill burden hits highest ever level at £15,649 per person | Personal Finance | Finance | Express.co.uk

SOLVED: When a good is taxed, the burden of the tax falls mainly on consumers if a. the tax is levied on consumers. b. the tax is levied on producers. c. supply